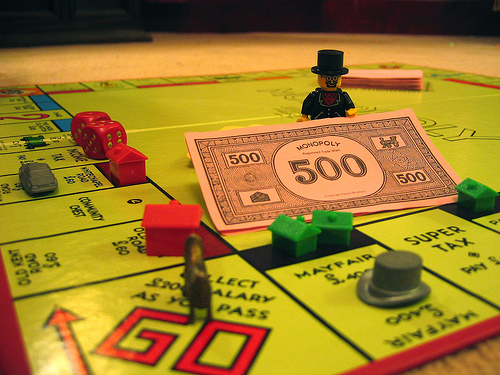

Good money after bad

When I was in my late teens, dirt poor, and new to credit cards, I learned very quickly that I could get a cash advance on one card to pay the minimum amount due on another card. As the amount I owed spiraled upward along with the minimum payments, I realized that this strategy would have one inevitable outcome. So why is this simple economic lesson beyond the ken of the sages running our government?

When I was in my late teens, dirt poor, and new to credit cards, I learned very quickly that I could get a cash advance on one card to pay the minimum amount due on another card. As the amount I owed spiraled upward along with the minimum payments, I realized that this strategy would have one inevitable outcome. So why is this simple economic lesson beyond the ken of the sages running our government?

After betting the farm, the Benz, the Rolex and the college fund, Congress is about to take another $800 billion economic stimulus gamble. But economists say it may be time for an intervention.

The federal budget deficit already is projected to reach an unheard of $1.2 trillion this fiscal year, and President-elect Barack Obama’s economic stimulus package, under review by lawmakers, would only add to the deficit.

That’s on top of a $700 billion financial rescue, a $17 billion auto bailout and the first $150 billion stimulus (that’s the one approved right before the worst economic crisis since the Great Depression).

So where does it end?

(from Economists Warn Against Feeding ‘Trillion-Dollar Deficits’, FOXNews.com)

Anyone over the age of 20 who has ever had a credit card knows where it ends. So why don’t our elected representatives?

![[x]](/images/sigil_md.jpg) Blackmoor Vituperative

Blackmoor Vituperative